Enjoy unlimited access to all forum features for FREE! Optional upgrade available for extra perks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

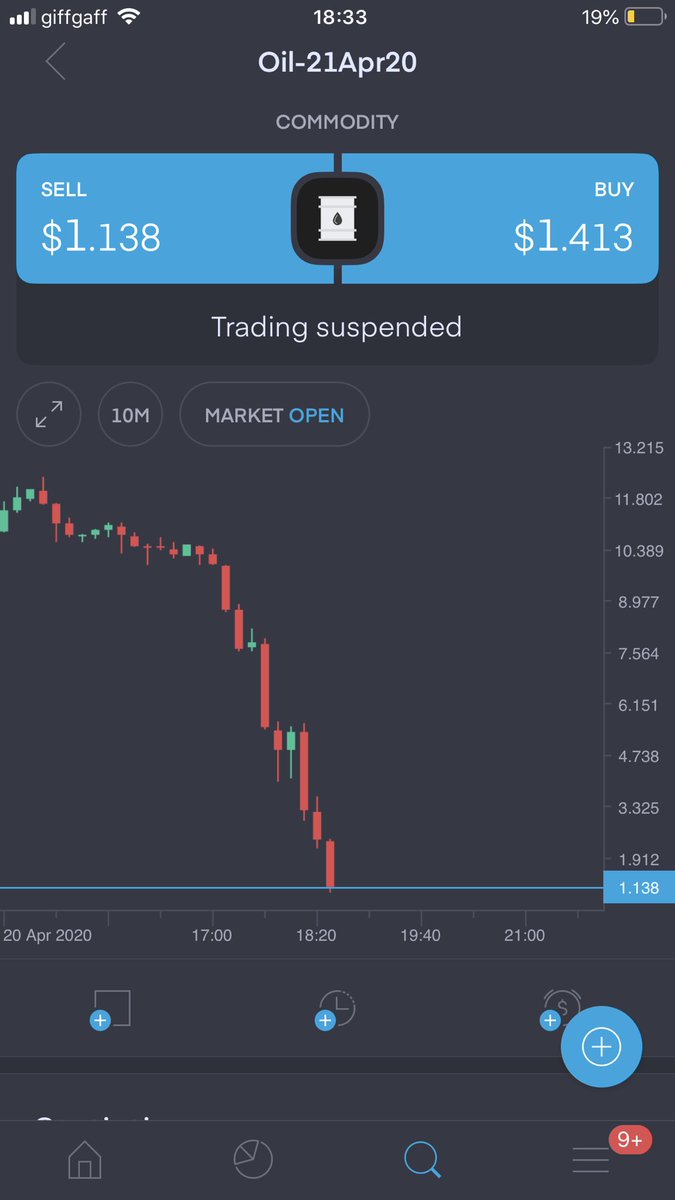

Oil now cheaper than beer

- Thread starter diablo

- Start date

- Joined

- Dec 22, 2009

- Posts

- 3,096

- Reaction score

- 247

How can one, if possible, profit from these lows?

Could always buy stocks in oil companies under the assumption that eventually the only way is up

- Joined

- Sep 3, 2012

- Posts

- 4,265

- Reaction score

- 1,039

Could always buy stocks in oil companies under the assumption that eventually the only way is up

I have stocks in Shellb, Chevron and Exxon

They're only 5% down on the day though (the US ones), nothing drastic

If they drop more I will buy more

On Etoro it says oil is $21 somehow - https://www.etoro.com/markets/oil

USO is $3.76 - https://www.etoro.com/markets/uso

- Joined

- Mar 25, 2018

- Posts

- 2,625

- Reaction score

- 806

Oil futures are $22

- Joined

- Dec 22, 2009

- Posts

- 3,096

- Reaction score

- 247

I have stocks in Shellb, Chevron and Exxon

They're only 5% down on the day though (the US ones), nothing drastic

If they drop more I will buy more

On Etoro it says oil is $21 somehow - https://www.etoro.com/markets/oil

USO is $3.76 - https://www.etoro.com/markets/uso

Oh yes of course. Yes that tends to be a common move, to top up in bad times. 5% is still quite a reduction, but I see your point. It doesn't seem like its capable of going much lower!

- Joined

- Nov 11, 2005

- Posts

- 2,342

- Reaction score

- 572

Oil futures are $22

Depends what futures you are talking about.

US oil futures trading below zero. Sellers have to pay buyers to take it.

https://www.wsj.com/articles/why-oil-is-11-a-barrel-now-but-three-times-that-in-autumn-11587392745

- Joined

- Nov 11, 2005

- Posts

- 2,342

- Reaction score

- 572

How can one, if possible, profit from these lows?

Buy a few barrels and keep them in your shed

Remember this is oil, not oil shares.

- Joined

- Mar 25, 2018

- Posts

- 2,625

- Reaction score

- 806

That really isn't a bad option. Especially if they start paying you to take them awayBuy a few barrels and keep them in your shed

Remember this is oil, not oil shares.

- Joined

- Sep 3, 2012

- Posts

- 4,265

- Reaction score

- 1,039

Buy a few barrels and keep them in your shed

Remember this is oil, not oil shares.

What about USO?

I created an overlay of USO price vs Oil

https://cabotwealth.com/daily/etfs/3-oil-etfs-to-buy/

USO is the best pure-play fund that tracks crude oil prices; it’s the largest, most liquid of futures-backed oil ETFs, with 28 million shares exchanging hands daily and roughly $1.4 billion in assets. Over the past five years USO has had a 0.96 correlation (1.0 is the highest) with crude. That’s a bad thing now – USO is down 45% year to date. However, when oil prices finally bottom, this is the purest way to buy the rebound.

- Joined

- Mar 25, 2018

- Posts

- 2,625

- Reaction score

- 806

Not a good idea at the moment https://www.nasdaq.com/articles/uso-getting-very-oversold-2020-04-20

Can our government prop up the capitalist system that currently exists as it did in the Banking crisis. Branson looking to borrow half a billion from the taxpayer and is offering his Island as security. Should he have maybe not bought the Island and kept the liquidity for a rainy day. Can the mega rich now retain their own private wealth by holding the country to ransom on jobs.

- Joined

- Mar 25, 2018

- Posts

- 2,625

- Reaction score

- 806

I think Branson can piss off frankly.

- Joined

- Apr 5, 2005

- Posts

- 9,851

- Reaction score

- 1,337

USO just fell 25%. One analyst described the movement in the fund as "It's turning into one of the great incinerations of retail money of all time."

https://www.forexlive.com/news/!/heres-why-it-could-get-even-uglier-for-oil-20200421

https://www.forexlive.com/news/!/heres-why-it-could-get-even-uglier-for-oil-20200421

- Joined

- Oct 13, 2012

- Posts

- 1,411

- Reaction score

- 355

USO just fell 25%. One analyst described the movement in the fund as "It's turning into one of the great incinerations of retail money of all time."

https://www.forexlive.com/news/!/heres-why-it-could-get-even-uglier-for-oil-20200421

The idea that what goes down must come up again is really no better than the gambler's fallacy.

Normally when folks start saying 'this is a new paradigm' it's a sign that the trend is about to reverse. Now, who knows?

That's the thing about conventions, they're always right until they're not.

- Joined

- May 8, 2013

- Posts

- 2,598

- Reaction score

- 910

USO just fell 25%. One analyst described the movement in the fund as "It's turning into one of the great incinerations of retail money of all time."

https://www.forexlive.com/news/!/heres-why-it-could-get-even-uglier-for-oil-20200421

just bought a small amount. No leverage so would need to go to zero (which is possible !)

- Joined

- Jan 10, 2008

- Posts

- 4,156

- Reaction score

- 812

The dump as a result of cancellation of May contracts; we are now in June/July contracts but I'm not convinced we'll see a recovery for quite some time. Those companies/industries with the ability to store will be stocked up nicely now (and paid for it); they won't be buying again for a while!

Similar threads

- Replies

- 0

- Views

- 202

- Replies

- 21

- Views

- 2K

- Replies

- 0

- Views

- 196

The Rule #1

Do not insult any other member. Be polite and do business. Thank you!

Featured Services

Sedo - it.com Premiums

New Threads

-

DN Journal Defining Success: With $300,000+ Sale of Pose.com New Kate & Todd Partnership Already Paying Off

- Started by Acorn Newsbot

- Replies: 0

-

-

-

-

Domain Name Wire Buying a house from domain investing – DNW Podcast #485

- Started by Acorn Newsbot

- Replies: 1

Domain Forum Friends

Other domain-related communities we can recommend.